Christmas party season is upon us!

For the past few weeks workplaces across the country have been holding their Christmas Parties with great enthusiasm as the 2017 work year comes to a close.

Amongst the big decisions to be made like what to wear, how drunk to get or whether to wear a Santa hat or reindeer ears, there is one thing to be considered that probably won’t engage the team with the same level of excitement as the choice of entertainment. That consideration is how Fringe Benefits Tax (FBT) will impact every aspect of the function.

The location of the event, the entertainment provided, the gifts given and the people who attend the event all create FBT considerations that can prove to be a headache long after the party induced headache has worn off.

So Peter thought it timely to revisit a previous Post about how FBT impacts Christmas parties. We hope this doesn’t dampen your Christmas spirit!

Bah Humbug!

This is the sound of the Australian Tax Office (ATO) coming to your Christmas party. Specifically, it is the sound of the ATO imposing Fringe Benefits Tax (FBT) upon you for hosting a Christmas party.

It doesn’t really sound like the ATO are celebrating the spirit of the festive season does it? Well, it’s not just Christmas parties that are impacted by the FBT legislation, it is many aspects of entertainment. So as we are all busy preparing for the Holidays, considering what gifts to give and what food to serve, it is important to consider what tax implications may arise as a result of giving those gifts and hosting those parties.

There is no separate FBT category for Christmas parties and you may encounter many different circumstances when providing these events to your staff. Fringe benefits provided by you, an associate, or under an arrangement with a third party to any current employees, past and future employees and their associates (spouses and children), may all attract FBT.

However as the festive season is upon us, let’s focus on Christmas parties.

HOW DO CHRISTMAS PARTIES WORK?

Two important issues impact how FBT will be calculated.

ENTERTAINMENT

The provision of entertainment means the provision of:

- Entertainment by way of food, drink or recreation(*);

- Accommodation or travel in connection with, or to facilitate the provision of, such entertainment.

(*)Recreation includes amusement, sport and similar leisure-time pursuits and includes recreation and amusement in vehicles, vessels or aircraft (for example, joy flights, sightseeing tours, harbour cruises).

MINOR BENEFIT

A minor benefit is provided to an employee/associate if done so on an infrequent or irregular basis and the cost is less than $300 inclusive of GST per employee/client.

The ATO don’t actually hate Christmas parties, I am sure they have their own and I am sure they even have Santa deliver presents. However parties like the typical Christmas party are often subject to FBT unless certain conditions apply. For these purposes we will assume that the employer has not elected to value the meal entertainment expenditure under the 50/50 split method or the 12 week register method so by default, the value is calculated using the actual method.

WHERE TO HOLD THE PARTY?

Business premises

If you hold your Christmas party on the business premises on a working day this is usually the most tax effective. Expenses such as food and drink are exempt from FBT for “employees” with no dollar limit, but no tax deduction or GST credit can be claimed. The reason for this is because there is no “recreation” component.

So for employees it works like this:

Food and Drink (with no dollar limit) – No FBT, No Tax Deduction, No Input Tax Credit (ITC)

Recreation (e.g band) <$300 per guest – No FBT, No Tax Deduction, No ITC

Recreation (e.g band) >$300 per guest – FBT applies, tax deductible and ITC available

For family members attending:

Food and Drink <$300 per guest – No FBT, No Tax Deduction, No Input Tax Credit (ITC)

Food and Drink >$300 per guest – FBT applies, tax deductible and ITC available

Recreation (e.g band) <$300 per guest – No FBT, No Tax Deduction, No ITC

Recreation (e.g band) >$300 per guest – FBT applies, tax deductible and ITC available

Restaurant / Function Centre

If your function were held off the business premises the rules are slightly different:

For employees:

Food and Drink <$300 per guest – No FBT, No Tax Deduction, No Input Tax Credit (ITC)

Food and Drink >$300 per guest – FBT applies, tax deductible and ITC available

Recreation (e.g band) <$300 per guest – No FBT, No Tax Deduction, No ITC

Recreation (e.g band) >$300 per guest – FBT applies, tax deductible and ITC available

For family members attending:

Food and Drink <$300 per guest – No FBT, No Tax Deduction, No Input Tax Credit (ITC)

Food and Drink >$300 per guest – FBT applies, tax deductible and ITC available

Recreation (e.g band) <$300 per guest – No FBT, No Tax Deduction, No ITC

Recreation (e.g band) >$300 per guest – FBT applies, tax deductible and ITC available

For Clients attending:

Regardless of the cost or the location (business premises or another venue) there is no FBT, nor is there a tax deduction or Input Tax Credit available for food and drink or any recreation component provided to clients or suppliers. The reason for this is that FBT applies in relation to employment and as a result clients fall outside the FBT system.

HOW DO GIFTS WORK?

For gifts, a distinction needs to be made as to whether the gift is categorised as a “Non-entertainment gift” or whether there is an “Entertainment” component.

“Entertainment” type gifts include movie, theatre, sporting tickets, holiday vouchers or admission to an amusement centre. Whereas “Non-Entertainment” type gifts include Christmas Hampers, a bottle of whiskey or wine, gift vouchers, perfume, flowers or a pen set.

For gifts given to clients that are entertainment based there is no FBT applicable nor is there a tax deduction available. However, should you give a client a bottle of wine, carton of beer or a Christmas ham rather than movie tickets, these would be tax deductible.

Entertainment Gifts:

For employees:

Gift costs <$300 – No FBT, No Tax Deduction, No Input Tax Credit (ITC)

Gift costs >$300 – FBT applies, tax deductible and ITC available

For family members:

Gift costs <$300 – No FBT, No Tax Deduction, No Input Tax Credit (ITC)

Gift costs >$300 – FBT applies, tax deductible and ITC available

For Non-entertainment gifts:

For employees:

Gift costs <$300 – No FBT, tax deductible and ITC available

Gift costs >$300 – FBT applies, tax deductible and ITC available

For family members:

Gift costs <$300 – No FBT, tax deductible and ITC available

Gift costs >$300 – FBT applies, tax deductible and ITC available

For gifts costing less than $300.00 given to employees and family members no FBT would apply but these are tax deductible so feel free to hand out Christmas hams, perfume or shopping vouchers. This is the most tax effective and economic option.

The rules regarding the minor benefit exemption have changed so you should feel free to give the gifts at the Christmas Party rather than a few weeks before as was previously the case. This is because the Gift and the cost of the function are considered to be separate benefits.

CONCLUSION

The FBT implications for Christmas parties and gifts can be quite complicated. There are many different variables and combinations that can change the tax deductible nature and the Fringe Benefits implications for having an event or giving a gift.

Nobody wants tax to ruin their Christmas parties or for it to be the deciding factor on what gifts your staff or clients will receive, however it must be an important consideration.

What will PTAM be doing?

Well, I hope our staff and their family members like comedians, Italian food and bottles of vodka costing no more than $299.00.

However, should this all seem too complicated, please contact us and we can discuss your particular circumstances.

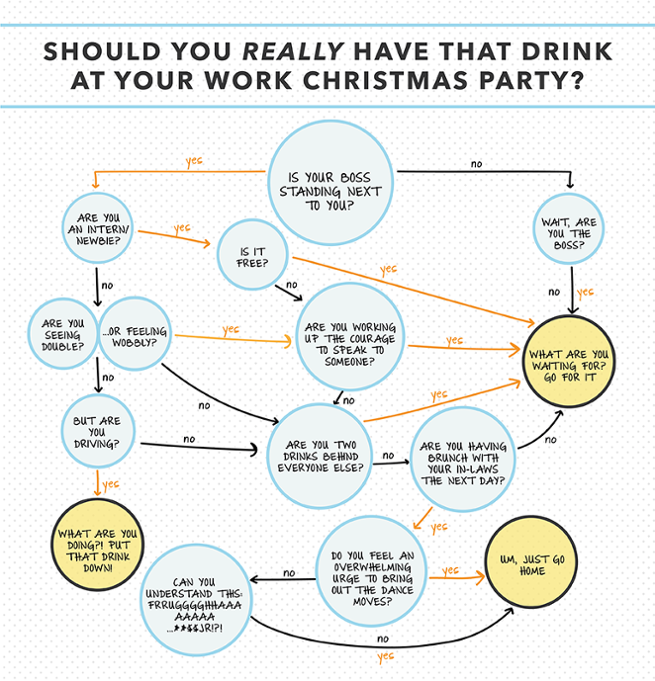

Or at the very least, enjoy a drink and perhaps take the advice of Mallika Goel and follow her handy flowchart below: