Every year the Oxford English Dictionary releases its list of new words that have been added to the official dictionary.

In 2015 the list included words such as totes, twerking, shirt front and suki. I am not sure what this says about me but I have used all of these.

There isn’t as much discussion regarding the addition of assets to the Australian Taxation Office’s capital allowance effective life determinations. However, just like the dictionary this debate occurs annually. The Tax Office is now seeking comments regarding a draft list of additions to its capital allowances effective life determinations to tie in with the annual tax ruling.

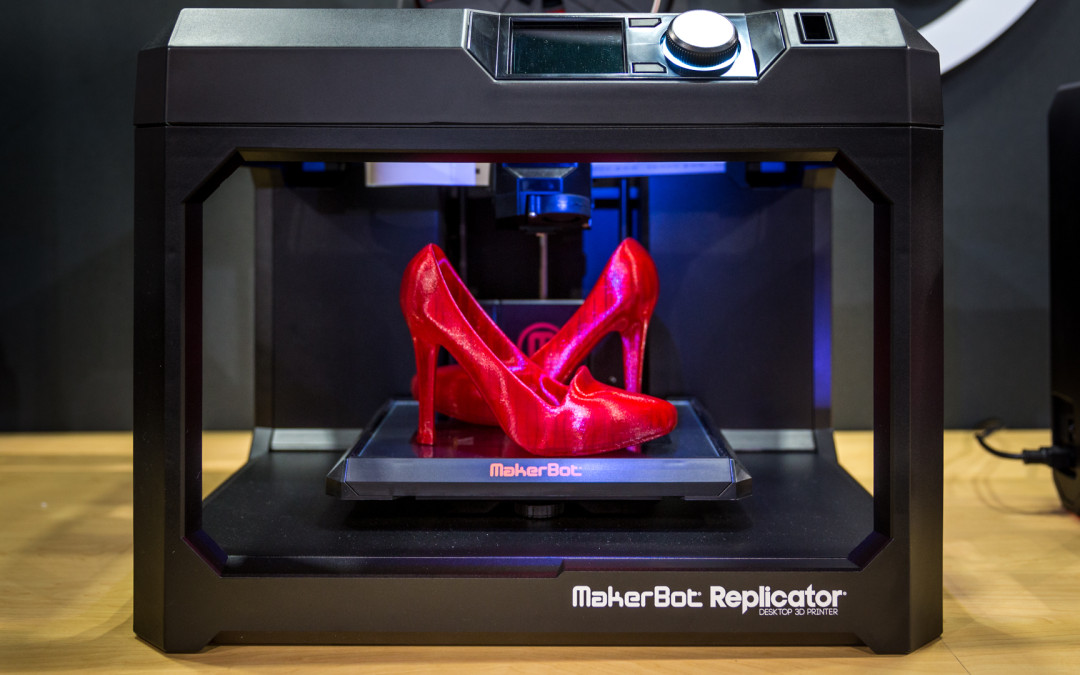

Topping the list of new “things” are 3D printers, including “additive manufacturing” printers, and other relevant supporting equipment for final product finishing that have a proposed three and four years effective life.

These will be classified in the ruling as non-industry specific assets, and also include computer equipment not specified elsewhere, including data storage equipment, mainframe computers, mobile devices (including tablets and “phablets”). See the full list here.

The Tax office also proposes to remove the very general terms “Computers: generally” and “Computers: laptops” from the existing list. Interestingly, mobile devices have a two year effective life that seems to fit quite nicely with “bundled contracts” provided by the communication providers.

The Tax Office proposes to include these changes in the list of effective life determinations, and to have this apply to assets purchased (or otherwise first used or installed ready for use) on or after July 1, 2016.

If you would like to provide feedback, please send comments to Susan.Li@ato.gov.au before February 29.

Of course, as a taxpayer, you always have the option to self-assess the effective life of any assets provided that certain requirements are met. We will be looking out for the final release but if you have any questions on the process or how you can maximise your deductions for depreciation please do not hesitate in contacting our office.